Latin America has become a key and innovative market in the specification, acquisition, and distribution of secure government documents. Cutting-edge innovation solutions focused on high-security printing and the authenticity of critical documents—such as banknotes, passports, and identification cards—are setting the trend in generating productive traceability projects for governments. These systems ensure communication with the consumer by guaranteeing the origin of the products they use.

Fiscal Traceability Systems are based on the unique identification of each product subject to specific taxes, such as beverages or cigarettes. Their purpose is to identify legal products and distinguish them from illegal ones through information technologies and high security, both physical and digital. These systems enable the verification of product legality throughout the entire distribution and commercialization chain.

Today, their impact is key in the fight against illicit trade, and they are endorsed by international organizations as efficient tools against smuggling and tax evasion. In this regard, the United Nations Interregional Crime and Justice Research Institute (UNICRI), in its 2016 report “Securing the Supply Chain: The Role of Technologies Against Smuggling, Counterfeiting, and Illicit Trade”, recognized this system as the most efficient, being implemented in more than 30 countries worldwide for the control and traceability of these products.

The Case of the TRAFICO System in the Dominican Republic

Some of the countries that have implemented fiscal traceability are Kenya, Morocco, Turkey, and, in the Americas, Canada, the United States (states of California and Massachusetts), Brazil, Chile, Ecuador, and the Dominican Republic. All of them have experienced increases in tax revenues ranging from 20% to 50%.

In the Dominican Republic, the General Directorate of Internal Taxes has successfully promoted the TRAFICO System, which has been applied to alcoholic beverages and cigarettes using both physical and digital tax marking technologies. This system has been a regional pioneer, representing the government’s first step toward maintaining control and fiscal traceability of products subject to selective consumption taxes.

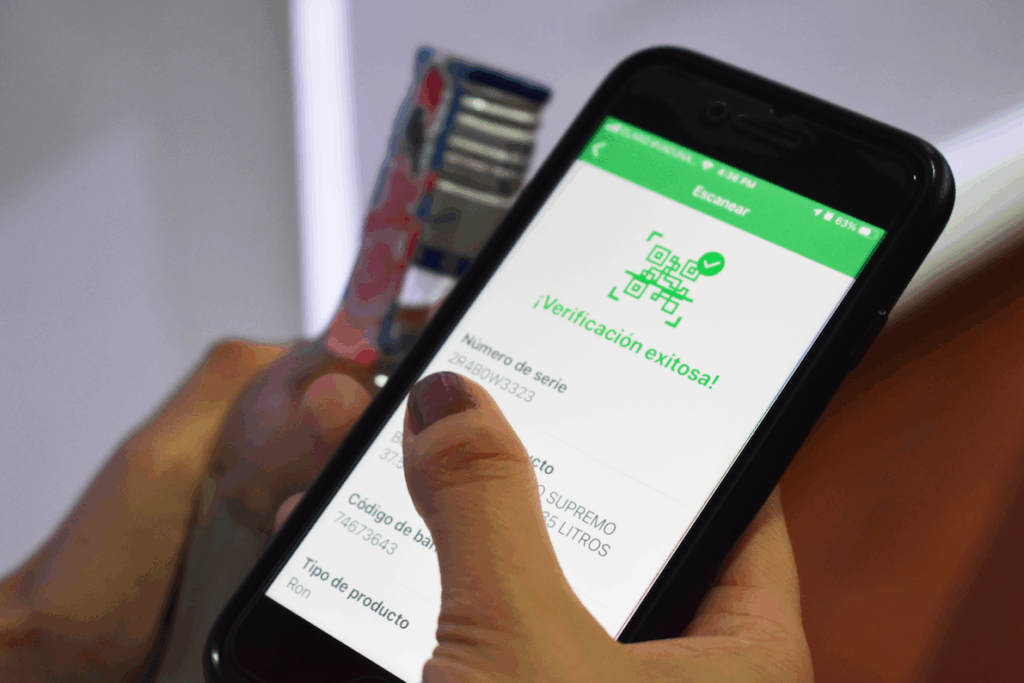

This system, which integrates physical and digital security components into fiscal control stamps—including Blockchain technology and the mobile app “Revísame”, which allows consumers to verify the authenticity of alcoholic beverages—has strengthened fiscal control for authorities, helped consumers verify the authenticity and legality of alcoholic beverages and cigarettes, and fostered a public-private partnership in the defense of authorized producers and distributors of these products.

The TRAFICO system was established with the clear objective of reducing tax evasion on these products, positioning itself at the forefront in Latin America in the implementation of first-generation solutions. As a result, the implementation of the TRAFICO system has had a positive impact on reducing deaths from adulterated alcohol consumption, dropping from 400 deaths in 2020–2021 to none after the system’s full incorporation. In addition, selective consumption tax revenues increased by more than 162 million dollars in 2021 compared to 2019, representing the highest increase recorded in the last 10 years for this tax.

OECD Recommendations for Tobacco Taxation in Latin America

A few days ago, the Organisation for Economic Co-operation and Development (OECD) released the report “Tobacco Taxation in Latin America and the Caribbean: The Urgency of Reform,” which, in addition to pointing out the advisability for countries to continue increasing the tax burden on cigarettes to prevent smoking and reduce prevalence, advocates for a substantive improvement in the oversight and enforcement capacity for the associated taxes that smokers pay, the tobacco industry collects, and which must be remitted to the treasury.

That report also mentions that the countries in the region that already have tobacco tax traceability systems should move forward in exchanging the information they collect regarding cigarette production and trade volumes, because the analysis of that [data] will be useful in preventing forms of smuggling, illegal trade, and tax evasion.

Among many conclusions and recommendations, the report points out that regional coordination and cooperation on tobacco tax policies is, therefore, one of the priority reforms for the region..

When many industries point out to governments that it is imperative to update strategies and provide resources to better confront the organized crime behind smuggling and illicit trade, this is another compelling reason for marking systems to become more relevant in the contribution they can make toward these ends.